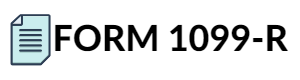

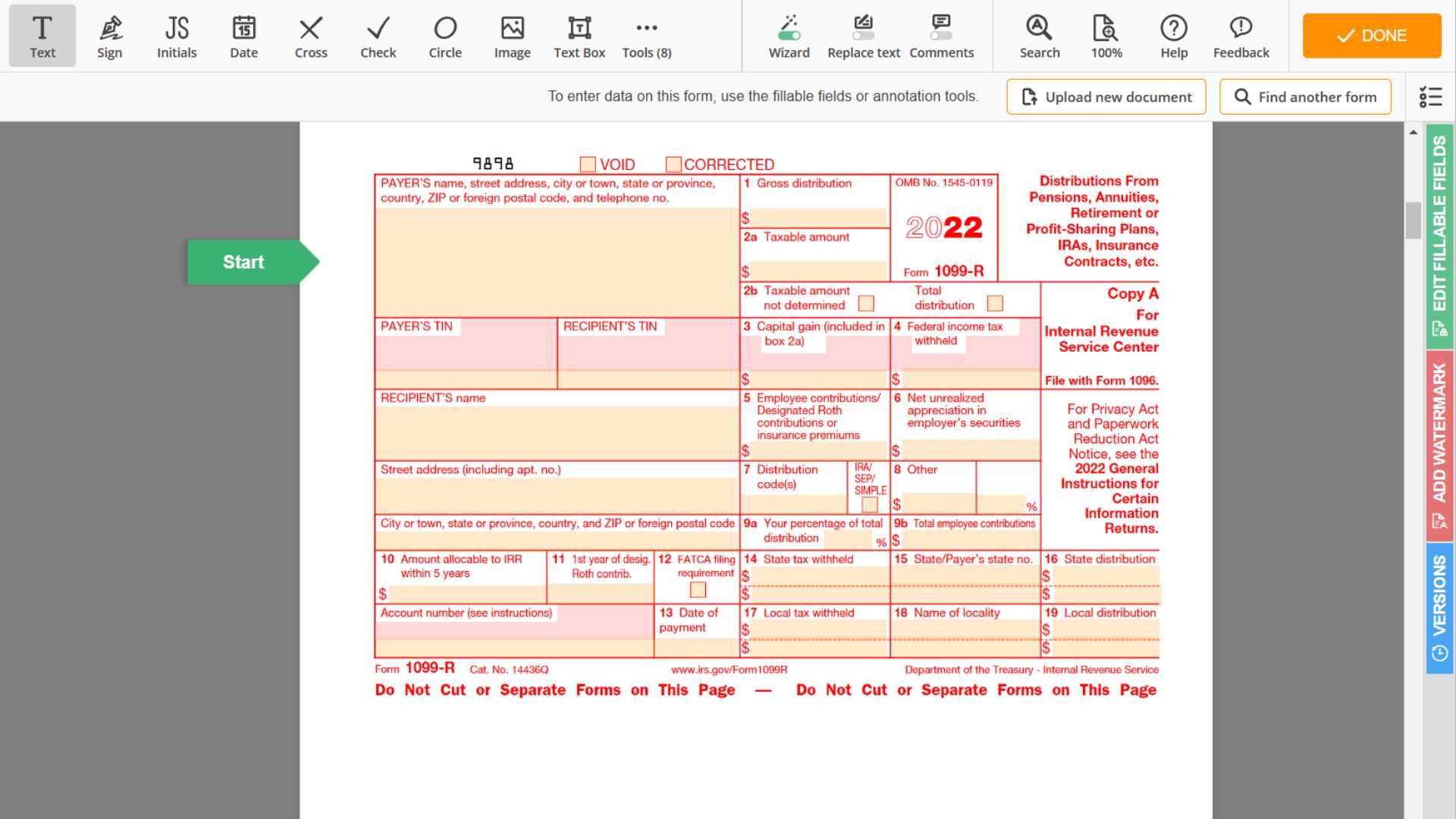

This is a tax form that reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other similar sources. IRS Form 1099-R for 2022 shows the distribution amount, the federal and state taxes withheld if any, and any contributions made to the plan already taxed.

The website 1099r-form.com offers valuable resources to help individuals fill out the blank 1099-R form for 2022 accurately and efficiently. The website provides instructions on how to complete the template, along with relevant examples for reference. These materials can help taxpayers avoid common errors, such as reporting incorrect amounts or failing to include all necessary information. Additionally, the website offers information on the deadlines for filing the free fillable 1099-R form, as well as links to other valuable resources for taxpayers. Overall, the website is a valuable tool for anyone who needs help, whether an individual or a business owner. Using the resources available on 1099r-form.com, taxpayers can ensure that their IRS Form 1099-R PDF is completed correctly and filed on time, avoiding possible penalties or other issues with the IRS.

Conditions for Using the 1098-R Tax Form

This federal tax form must be filed by anyone who distributed $10 or more from a retirement or profit-sharing plan, IRA, annuity, or insurance contract during the last year. For 2022, the 1099-R fillable form reports the taxable distributions to the beneficiaries, including any taxes withheld.

However, there are some exemptions for filling and filing the federal tax form 1099-R, which include:

- If the distribution is less than $10.

- If the distribution is a return of a contribution.

- If the distribution is a rollover to another retirement account.

- If the distribution is due to death, disability, or illness.

- If the distribution is corrective.

If you need to file the printable 1099-R tax form, you can obtain a blank template from the IRS website or other tax preparation websites. You can choose to print the blank copy and fill it out by hand, or you can complete it online using the fillable PDF version.

The 1099-R and 1099-MISC might be connected to an individual receiving both retirement-related and miscellaneous income during the tax year. Each form provides specific details about the type of income it covers, aiding taxpayers in fulfilling their reporting obligations to the IRS. Follow the link from our website to get the free online 1099 form template for the relevant year.

IRS Form 1099-R: Rules to Fill Out Correctly

If you've received a distribution from a retirement plan or pension, you'll likely need to file a printable 1099-R form for 2022 with the Internal Revenue Service (IRS). It reports the distribution and any taxes withheld to the federal government. Here's a step-by-step guide on how to fill in and file it correctly.

- Get the 1099-R form online from the IRS website or purchase a printable template from a tax preparation service.

- Fill in the payer's information in the boxes at the top of the template, including their name, address, and federal identification number.

- Enter your personal information, including your name, address, and social security number in the boxes provided.

- Complete the distribution information, including the distribution code, the gross distribution amount, and any taxes withheld.

- If you received a distribution from a Roth IRA, check the box indicating that the distribution is qualified.

- If the distribution was made to a beneficiary, fill in their information in the appropriate boxes.

- Sign and date the tax form 1099-R example.

- Submit Copy A to the IRS and give Copy B to the recipient. Keep Copy C for your records.

Remember to file your copy with the IRS by the deadline, which is typically January 31st of the year following the distribution. The 2022 and 2023 instructions and sample forms are available on the IRS website in PDF format, or you can print the 1099-R tax form with them for reference. By following these steps, you can ensure that you accurately report your retirement plan distributions and avoid potential tax penalties.

More Instructions for IRS 1099-R Form

- What is IRS Form 1099-R?

This tax document is used to report distributions from pensions, retirement plans, annuities, and insurance contracts. The form is typically issued by the payer of the distribution and must be filed by the recipient of the distribution on their annual tax return. - Where can I find a blank IRS 1099-R form printable?

The IRS provides blank templates on its website. You can print the form's PDF version or fill it out online using the interactive version. The blank sample is also available from various tax preparation software providers. - What are the instructions?

The instructions cover topics such as who must fill out the 1099-R form, how to report different types of distributions, and how to calculate the taxable amount of the distribution. - When is the deadline?

The due date to file 1099-R online or via mail is January 31st of the next tax year. For example, if you received a distribution in 2022, you must file the document by January 31st, 2023. It is important to file the copy by the deadline to avoid penalties and interest charges from the IRS. - Is there a sample to get for the 1099-R form?

The sample is a completed template that can be used as a reference when filling out your template. It is important to note that the information on the sample may not be applicable to your specific situation, so it is important to review the instructions and consult with a tax professional if needed.

IRS Form 1099-R Instruction for 2022

IRS Form 1099-R Instruction for 2022

Form 1099-R VS W-2

Form 1099-R VS W-2

Tax Form 1099-R

Tax Form 1099-R

IRS Form 1099-R Instructions for 2022

IRS Form 1099-R Instructions for 2022

Free Printable 1099-R Tax Form

Free Printable 1099-R Tax Form